Dutch Pension funds do not vote in line with climate ambitions

Authors note rectification 13 April 2023

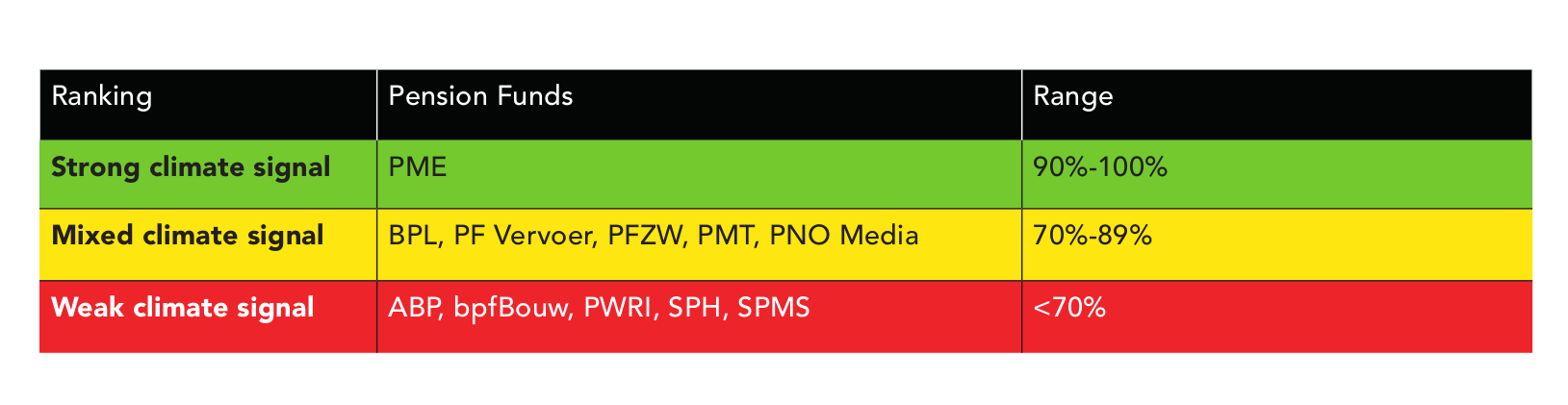

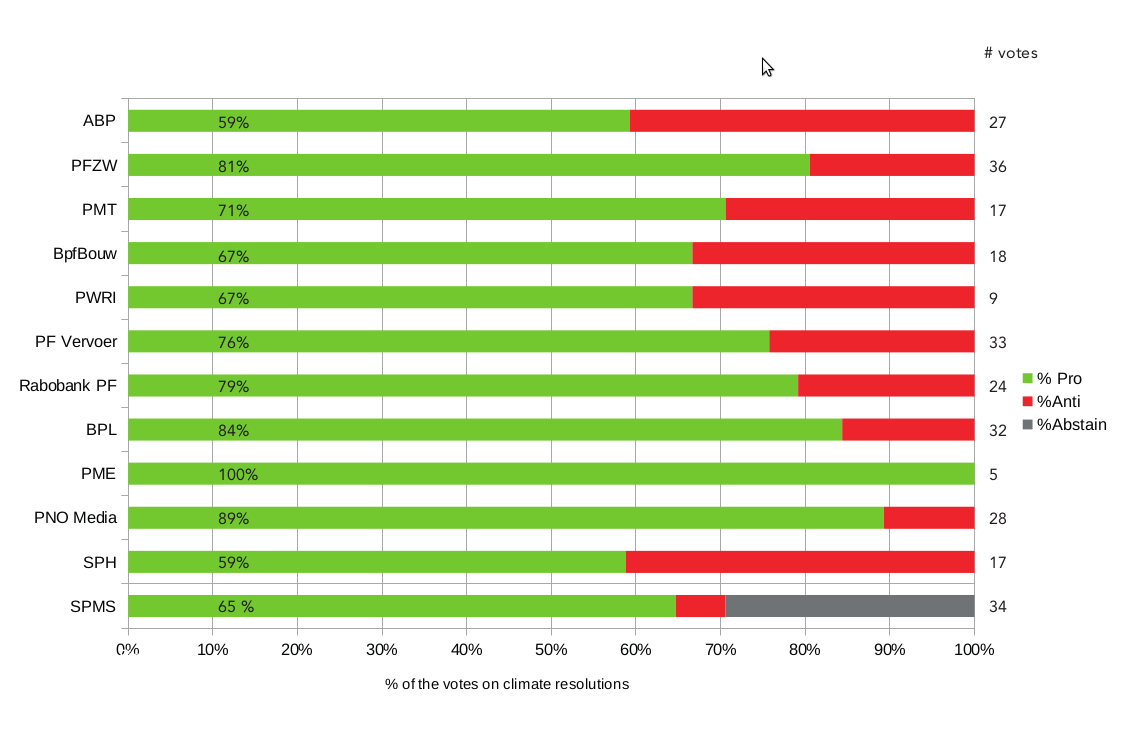

Most Dutch pension funds and their asset managers do not vote consistently in favour of climate resolutions at the oil and gas companies and banks in which they invest. That is the conclusion of a report published today by Both ENDS and Groen Pensioen. Eleven of the twelve* Dutch pension funds studied have made public statements and pledges about adapting their policies in line with the Paris Climate Agreement. But their voting behaviour does not sufficiently correspond with these pledges. Only pension fund PME votes for 100% in line with its own climate promises.

None of the companies involved in fossil fuels has drawn up a credible business plan compatible with the 1.5 degree goal agreed in Paris. Participants in pension plans have been calling on their pension funds for many years to withdraw from the fossil sector, but too little comes of that in practice. Some pension funds continue to invest in the sector with the stated intention to use their influence as shareholders to push fossil companies in the right direction. This study shows, however, that pension funds exert their influence insufficiently and that their engagement has hardly led a change of course among fossil companies.

Banks out of the fossil sector too

The researchers focused on voting behaviour on climate resolutions at oil and gas companies and banks. The latter play a key role as, without financing, fossil projects cannot be implemented. "Eleven of the twelve pension funds and their asset managers that we studied did not use their votes to send sufficiently strong messages," says Cindy Coltman of Both ENDS. "To have a realistic chance of keeping global warming below 1.5°C, it is essential that pension funds stop investing in oil and gas companies and exert pressure on banks to stop financing the fossil sector. And that is not happening enough."

Clear expectations

Pension funds normally vote in 75% to 98% of cases in favour of general resolutions, for example on the appointment of board members or management plans. The report shows that, in the case of climate resolutions, that percentage is much lower. Most pension funds vote in favour of the climate in only 58% to 89% of cases. "We would expect pension funds that claim to take the climate seriously to vote in favour of all resolutions that will have a positive effect on the climate," says Marjolein van Dillen of Groen Pensioen. "They have to overcome their fear of being 'too controlling or too difficult' for the companies in which they invest, and indicate clearly what they expect of the companies in terms of climate policy."

Using their influence

The researchers think that pension funds should lay out a clearer vision on fossil and sustainable investments. And they should be much more assertive in using the influence they have to redirect financing towards the renewable sector and climate solutions.

"We have seen that pension funds can show genuine leadership," says Coltman. "ABP and PME have almost entirely phased out their investments in fossil companies. That means that the pension funds we studied can utilise their engagement much more effectively or, if they really want to effect change, can withdraw from the fossil sector completely. We also believe that they should be much more transparent towards their pension savers about their plans and engagement in that respect. 'Business as usual' is no longer an option in a world that is wrestling with enormous climate problems".

* The pension funds studied were ABP, PFZW, PMT, BpfBouw, PWRI, PF Vervoer, Rabobank PF, BPL, PME, PNO Media, SPH and SPMS

Read more about this subject

-

Dossier /

Dossier /Towards a socially and environmentally just energy transition

To address the climate crisis we need to urgently transition away from fossil fuels towards clean, renewable energy. However, this transition is not only about changing energy sources. It requires an inclusive and fair process that tackles systemic inequalities and demanding consumption patterns, prioritizes environmental and social justice, and which does not repeat mistakes from the past.

-

Dossier /

Dossier /Making pension funds more sustainable

Pension funds have a lot of influence because of their enormous assets. Both ENDS therefore wants pension funds such as the Dutch ABP to withdraw their investments from the fossil industry and to invest sustainably instead.

-

Publication / 9 March 2023

-

Publication / 14 May 2017

-

News / 1 May 2019

News / 1 May 2019ABP still on collision course with Paris climate goals

Amsterdam 1 May 2019 - Dutch pension fund ABP's 'sustainable and responsible investment report’ today suggests that the pension fund is well on track in terms attaining its internal sustainability goals. However, an analysis by Fossielvrij NL, Both ENDS, urgewald and Greenpeace shows that ABP remains on a collision course with the Paris climate goals. At the end of 2018, ABP still invested 16.5 billion Euros in the fossil industry. ABP's investments in the world's 44 largest climate polluters even increased between 2016 and 2018.

-

Publication / 14 May 2017

-

Publication / 9 May 2018

-

Press release / 14 May 2017

Press release / 14 May 2017Criticism of Dutch pension fund ABP’s investments in coal, oil and gas

The Dutch pension fund, ABP, invested about two billion euros more in the fossil energy industry at the end of 2016 than the year before. This is announced by the report "Dirty & Dangerous: the fossil fuel investments of Dutch pension fund ABP," published today by Both ENDS, German urgewald and Fossielvrij NL. The report criticizes these investments because of the impact on the climate and the catastrophic consequences for the people in the areas where coal, oil and gas are being produced.

-

Press release / 9 May 2018

Press release / 9 May 2018ABP promises to go green but sticks with fossil fuels

New research by Both ENDS, Fossielvrij NL and urgewald shows that, in 2017, pension fund ABP invested 500 million euros more in coal, oil and gas than in the previous year – a total of 10.9 billion euros. These investments in fossil fuels not only stand in sharp contrast to ABP's claim that it has achieved substantial successes in its climate policy, but are also in flagrant violation of the Paris climate agreement. Unlike international forerunners among pension funds, ABP continues unabated to invest in the fossil energy sector.

-

Event / 19 June 2022, 12:30

Event / 19 June 2022, 12:30"Stop Fossil Finance" block Climate March

Still, more funds are spent on the fossil industry than on sustainable solutions. Banks, pension funds, insurers and governments keep investing in fossil infrastructure which endangers people and the environment. Therefore we call on financial institutions to stop funding the climate crisis.

Join our "Stop Fossil Finance" block at the next climate march!

-

Publication / 9 May 2018

-

Publication / 15 March 2023

-

News / 2 February 2020

News / 2 February 2020How to become a fossil-free investor

The world has to stop using fossil fuels, but investment in the sector continues unabated. Investors of all kinds, including banks, insurance companies and pension funds, are hesitant about making the change to sustainable energy and are not sure where to start. In the autumn of 2019, together with the DivestInvest Network and Sustainable Energy (Denmark), Both ENDS published a report entitled ‘Managed Decline of Fossil Fuel Businesses’. The report describes five criteria to test whether companies in the fossil sector are actively taking steps to wind down their fossil activities. The criteria are helping investors to choose investments that are in line with the Paris goal of restricting global warming to a maximum of 1.5 degrees Celsius. We spoke to Lars Jensen, Senior Analyst at Sustainable Energy and lead author of the report.

-

Publication / 24 October 2019

-

Press release / 24 October 2019

Press release / 24 October 2019Press Release: These five criteria help investors go green

Press release 24 October 2019

Starting today, investors can use five criteria to test whether companies in the fossil sector are actively working on phasing out their fossil activities. Too many investors still seem hesitant to switch to a profitable future of sustainable energy and these criteria should help them do this. The organisations DivestInvest Network, Sustainable Energy (Denmark) and Both ENDS (the Netherlands) publish the report "Managed Decline of Fossil Fuel Businesses" today, which describes these five criteria. The criteria aim to help investors choose investments that are in line with the Paris goal "stay below 1.5 degrees Celsius warming." The recommendations are presented at the World Pension Summit deliberately, because pension fund investors in particular can take more responsibility in this.

-

Publication / 13 November 2023

-

News / 26 November 2024

News / 26 November 2024The Time to Rethink Investment Rules: Amplifying Civil Society Voices

At the core of the Fair, Green, and Global (FGG) Alliance’s mission is the commitment to building a just and sustainable world. As members of this alliance, Both ENDS, SOMO, and the Transnational Institute (TNI) recognise the urgent need to reimagine global investment frameworks. These frameworks, entrenched in outdated treaties such as Bilateral Investment Treaties (BITs) and the Energy Charter Treaty (ECT), often prioritise corporate profits over human rights, environmental sustainability, and social justice.

-

Letter / 28 February 2023

175 CSOs call on world leaders to end OECD export finance for oil and gas

This joint position launched by 175 civil society organisations from 45 countries calls on world leaders to end OECD export finance for oil and gas, and explains how it can be done.

-

Press release / 3 February 2020

Press release / 3 February 2020Climate movement: ABP takes steps on coal and tar sands, but oil and gas remain blind spot

Amsterdam, 3 February 2020 - A step forward, but oil and gas remain a blind spot in Dutch pension fund ABP's new investment policy published today. That's what environmental organisations Both ENDS, Fossielvrij NL, Greenpeace Netherlands and urgewald say in response to the new climate policy of the EU's largest pension fund, with assets over 442 billion euros. Although ABP is taking first steps to invest sustainably, more is needed to stop the climate crisis.

-

News / 20 February 2023

News / 20 February 2023Almost 60 organisations send a letter about fossil export support to Dutch Parliament

Today, a letter, undersigned by almost 60 organisations from countries that face the consequences of fossil fuel projects or stand in solidarity, has been sent to the Dutch Members of Parliament. This Thursday, a debate about the export credit facility and the policies around it, will take place in the Dutch Parliament. The coalition calls upon Dutch politicians and policy makers to stand up against any form of export support for fossil fuel projects that are to be executed by Dutch companies abroad, expecially in the global South.